Do you recognize that a Flexi finance can aid you a lot in taking care of any such situation? Yes, it is true that through Flexi car loans, investors can deal with any kind of economic obstacle and can satisfy the demand of cash. The financial institution will verify your details as well as documents. For instance, take into consideration that Rs. 5 lakh has been sanctioned, but you make use of only Rs. 3 lakh of it. In such a circumstance, the payable passion will certainly be charged only on the Rs. 3 lakh you have actually obtained. Assimilation of home loan, savings and current accounts right into one account.

- However, you would still need to allow the lending institution confirm the papers like Financial institution Statement, Pan Card, Wage Slip, and Aadhar Card.

- There is a drop-line facility within the car loan tone with no added paperwork.

- You also approve iProperty's Terms of Use as well as Privacy Policy including its collection, usage, disclosure, handling, storage space as well as handling of your individual details.

- An approved limitation is fixed and also the exact same can be paid back as per the consumer's comfort.

You also have an option to get extra funds by availingTop up loanon your existing personal funding without much problem. There may be an impact that attempting to take out from a finance account might be difficult and also possibly will take a very long time to procedure before you see the real cash. The reality is, with Flexi Home mortgage accounts, it's just as easy as managing a savings account. You can move and also relocate funds with typical platforms such as online banking and also ATM. You will not need to fill up a stack of types, go through a rigorous authorization process just to access your cash.

Fundings are meant for financial freedom, and also you should only obtain when you need the amount. Bajaj Finserv Personal Loans for Financial debt Consolidation is made to soothe the consumers of accumulated debt mountain. Right here, you can obtain an Individual Finance as a Loan consolidation Funding and also handle the settlement by settling existing loans into one. Training is a worthy profession, and by expanding tailored loans for Educators, Bajaj Finserv has actually relocated an action ahead of its competition.

Home Mortgage" Flexi

Additionally, you can lower the authorized credit limit to an amount that suits you over the minimum of $4,000. A recurring credit line center you can access when you need to, without needing to reapply. [newline] Gain max rewards & retrieve for money back, worth back provides, discounts & exclusive deals. When you are preapproved for a funding, you have much better negotiation power on the amount, tenor and also rate of interest. You have actually been persistent in repayment of EMIs and Bank card bills. The rate of interest begins with 1% per month of the loan amount.

What Is A Flexi Loan?

Additionally, given that it is a line of credit, you do not have to come close to the credit institution every single time you need the money (fresh loan/withdrawal). You can repay/pre-pay the primary separately whenever you want. You obtain the adaptability to pay the exceptional car loan quantity as and also when you intend to pay, however you require to pay the rate of interest each month. Select your wanted car loan amount and tenure to get immediate approval. You can pre-pay the principal - either partially or full - without any costs. Contrast the two prominent variants of a personal funding and see which one suits you better.

If you have to go for an individual lending, do check out the rates of interest from various other gamers too as well as take a phone call appropriately. Bajaj Finserv Flexi Finance is, after all, an individual loan product. Because the financial institution pre-approves the credit limit, you are entitled to withdraw anytime depending upon your emergency. Not all are furnished with fluid cash to handle such scenarios. Just like others, you may be compelled to take credit scores to deal with the unintended expenditures.

Bajaj Finserv Slashes Personal Lending Interest Rate To 12 99%

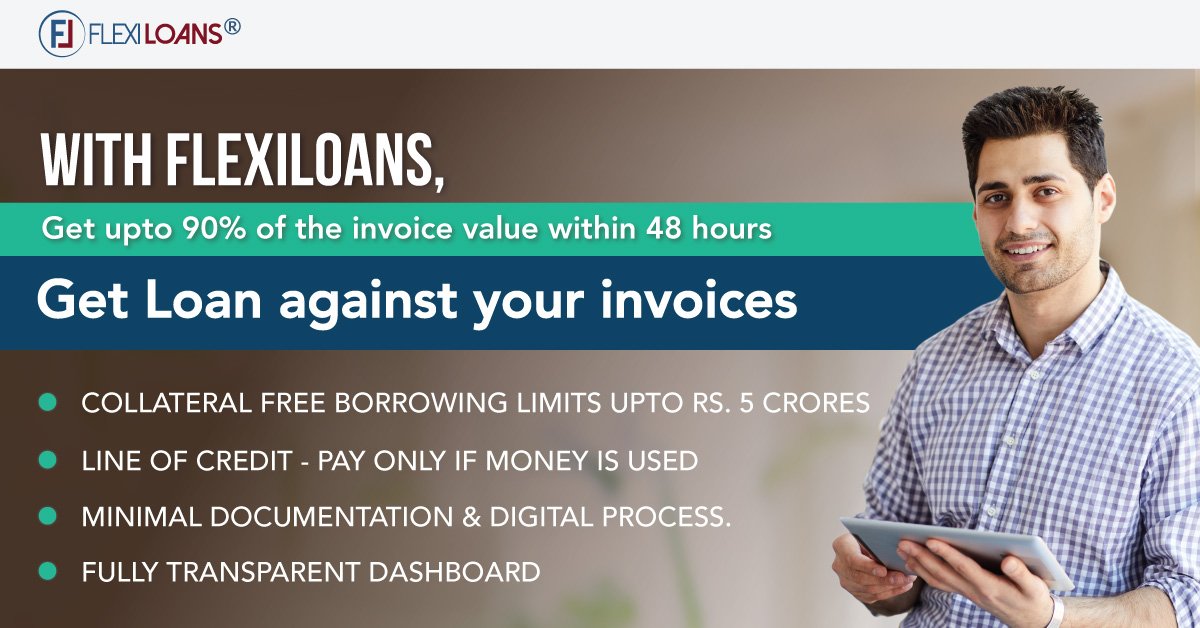

On the various other hand, the total financing quantity is paid out to your checking account in the Term Financing. In the term loan, EMIs make up both passion and primary part and hence regular monthly instalments are a lot more pricey than Flexi Loans. FlexiLoans does not bill any added or concealed prices for its financing products.

. You might also get flexi individual finances offline by visiting the branch of your recommended banks and also filling in an application. The offline application procedure is similar to the on the internet application procedure-- fill out an application and send your papers, to name a few points. Term car loans generally have a rigorous approval process that needs a good deal of documentation.